Capital Markets Advisory

CREFIC’s Capital Markets Advisory service is designed to help you secure the right funding for your commercial real estate projects. Our team crafts investor-ready materials, including investment memorandums and pitch decks, that clearly articulate your project’s financial strengths and capital structure. We simplify the complexities of deal financing so you can confidently attract equity investors and lenders.

- Investment Memorandum

- Offering Memorandum

- Pitch Deck Development

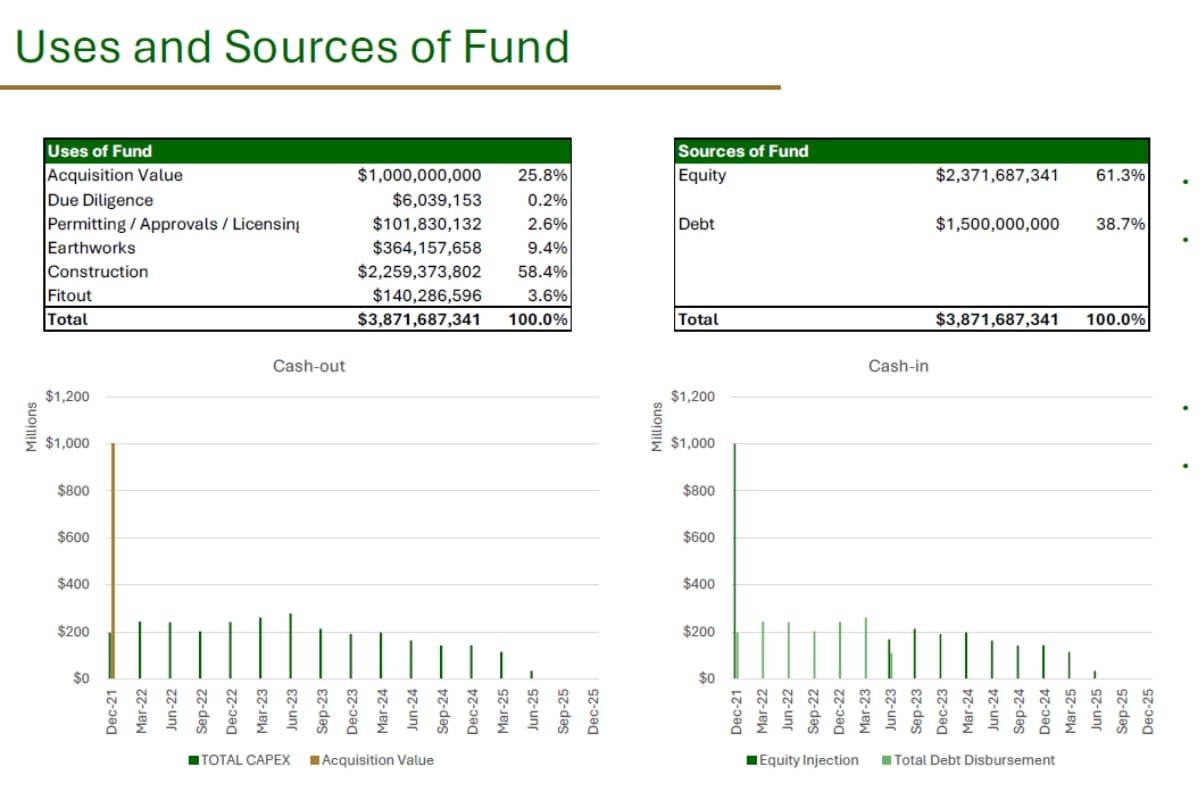

- Capital Structure Analysis

- Equity and Debt Arrangement Strategies

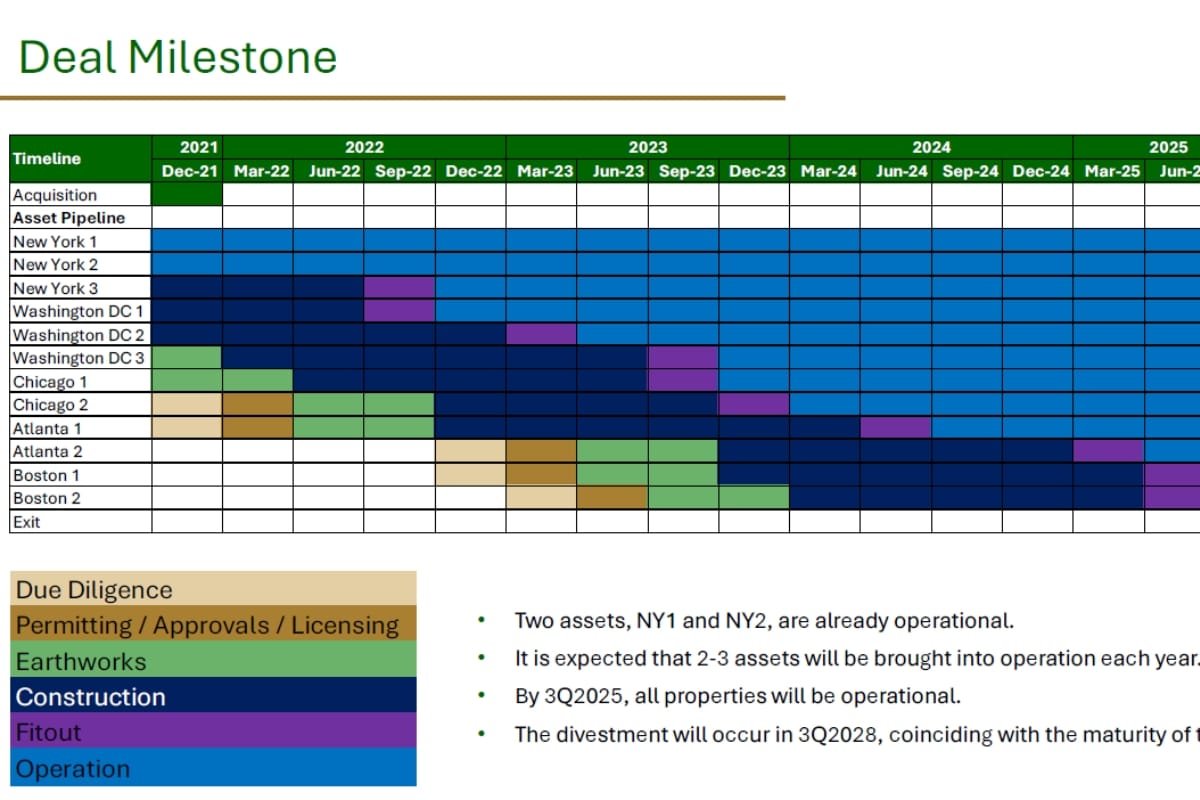

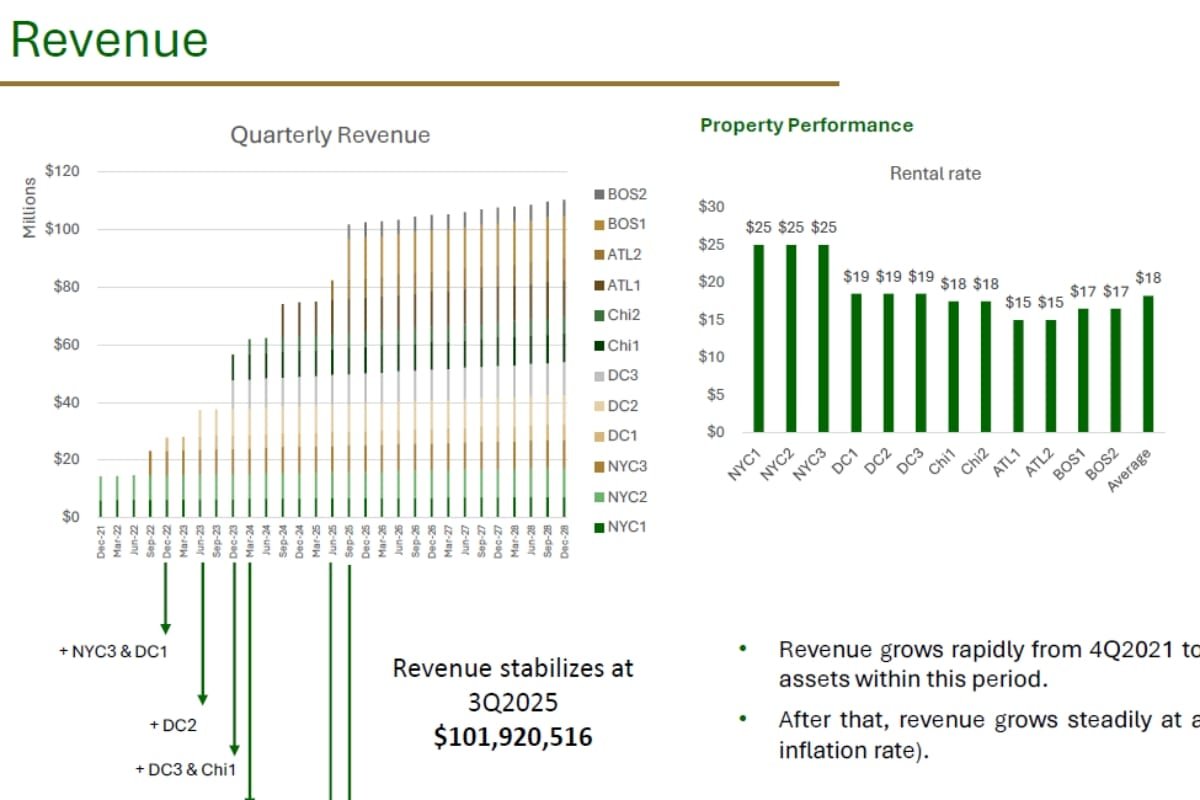

- Intuitive graphs and charts

- Cash flow projections

- Sensitivity analysis

Our Other Services

Our Approach To Capital Strategies

01

Model Assessment and Understanding

We begin by reviewing your existing financial model – whether provided by you or created by our team – to gain a clear understanding of the underlying assumptions and key metrics. This initial assessment ensures we start from a solid foundation and fully grasp the current financial structure of your project.

02

Investment Proposal Presentation

Next, we present a comprehensive overview that details property specifications, financial forecasts, deal structure, and fundraising strategies. This step transforms raw data into an investor-ready proposal that clearly outlines how your project will attract capital.

03

Refinement and Validation

We refine the documents based on market feedback and rigorous data validation. This step ensures that every financial projection and strategic recommendation is accurate and investor-ready, with visuals that make the complex data easy to understand.

Frequently Asked Questions

A well-crafted offering memorandum or pitch deck is essential because it distills complex financial information into a clear and persuasive narrative. It builds investor confidence by clearly outlining the opportunity and serves as a key tool in securing the necessary funding.

Our service transforms complex financial data into clear, investor-ready presentations that showcase your project’s strengths and potential returns. This approach simplifies the capital-raising process by providing a persuasive, data-driven narrative for potential investors.

We analyze and tailor a range of capital structures, advising on both equity and debt arrangements that best fit the specific financial goals and needs of your project.

A comprehensive pitch deck should include a concise project summary, clear property specifications, key economic indicators, an industry overview, detailed financial projections, a breakdown of the capital structure, and a risk assessment. Visual elements like graphs and charts further enhance clarity and impact.